- Christopher Seabrooke's 40.61% stake in Sabvest Capital has dropped by $4.44 million over 11 days, reducing his total investment below $70 million.

- Sabvest Capitals stock fell 6.25% recently, from $4.47 to $4.17 per share, lowering its market cap below $165 million.

- Year-to-date, Sabvest Capital shares have lost 0.64%, making a $100,000 investment worth $99,358, urging caution for potential investors.

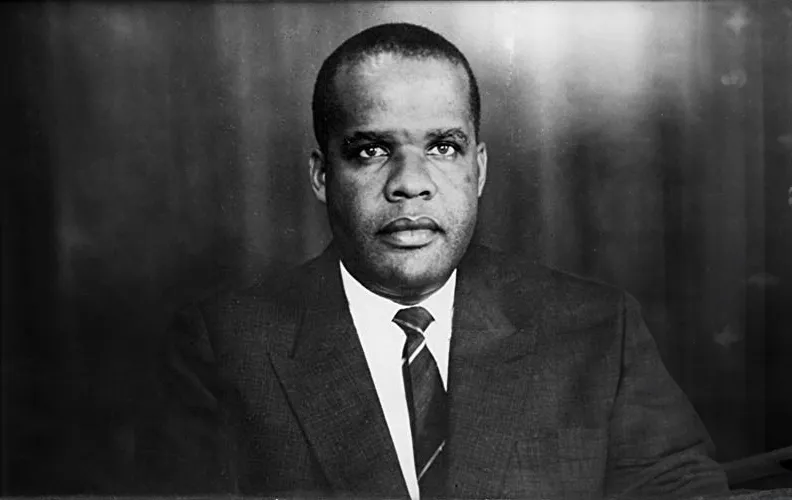

South African businessman Christopher Seabrooke has encountered a sharp decline in the market value of his stake in Sabvest Capital, resulting in a substantial loss of over $4 million.

The Johannesburg Stock Exchange (JSE)-listed investment holding company has experienced a notable drop in its share value, significantly impacting Seabrooke's investment.

Steep decline in share valueOver the past eleven days, Seabrooke, the largest shareholder of the Sandton-based investment holding firm, has seen the value of his 40.61 percent stake in Sabvest Capital plummet by R79.68 million ($4.44 million).

This downturn has reduced his overall stake to below $70 million. Previously, Seabrookes investment had witnessed a substantial increase. From May 10 to July 19, the market value of his shares surged by R159.84 million ($8.8 million), boosting his stake from R1.04 billion ($57.2 million) to R1.2 billion ($65.98 million).

Sabvest Capital's recent performanceSabvest Capital, headquartered in Sandton, engages in a range of investment activities, including finance advances and managing listed debt, equity, and cash portfolios. The firm holds significant interests in unlisted companies, as well as long-term direct and indirect holdings in listed firms, equity funds, and offshore bond portfolios.