- Pick 'n Pays Boxer supermarket chain will list on the JSE on November 28, aiming to raise R8-8.5 billion 442 million-470 million with plans for a secondary A2X listing.

- Proceeds from Boxers IPO will help Pick 'n Pay eliminate debt and reinvest in its core supermarket operations as part of a recapitalization strategy.

- Boxer, South Africas leading discount grocer, holds a 68 market share in its sector and plans to double its store count over the next six to seven years.

Boxer, a leading South African discount grocery chain and subsidiary of Pick 'n Pay, partly owned by the billionaire Ackerman family, is set to debut on the Johannesburg Stock Exchange JSE Main Board on Nov. 28. In preparation for the listing, Pick 'n Pay has opened the offering period for qualified investors, which runs from Nov. 11 to 22. Boxer also plans a secondary listing on the A2X exchange to expand its market reach and accessibility.

According to Billionaires.Africa, Pick 'n Pay aims to raise between R8 billion 442 million and R8.5 billion 470 million through the initial public offering IPO by offering up to 202.4 million shares, representing approximately 40 percent of Boxers share capital, at a projected price range of R42 2.3 to R54 2.9 per share. This valuation places Boxer between R21.1 billion 1.2 billion and R24.7 billion 1.3 billion.

Following the IPO announcement, Pick 'n Pay reported strong investor interest across the entire pricing range within hours. The final offer price and share count will be confirmed on Nov. 25, three days before Boxers anticipated debut on the JSE. Post-IPO, Pick 'n Pay intends to retain a controlling stake of about 60 percent to 65 percent, maintaining significant influence over Boxers operations and growth.

Boosting Pick 'n Pays core business with strategic financial moves

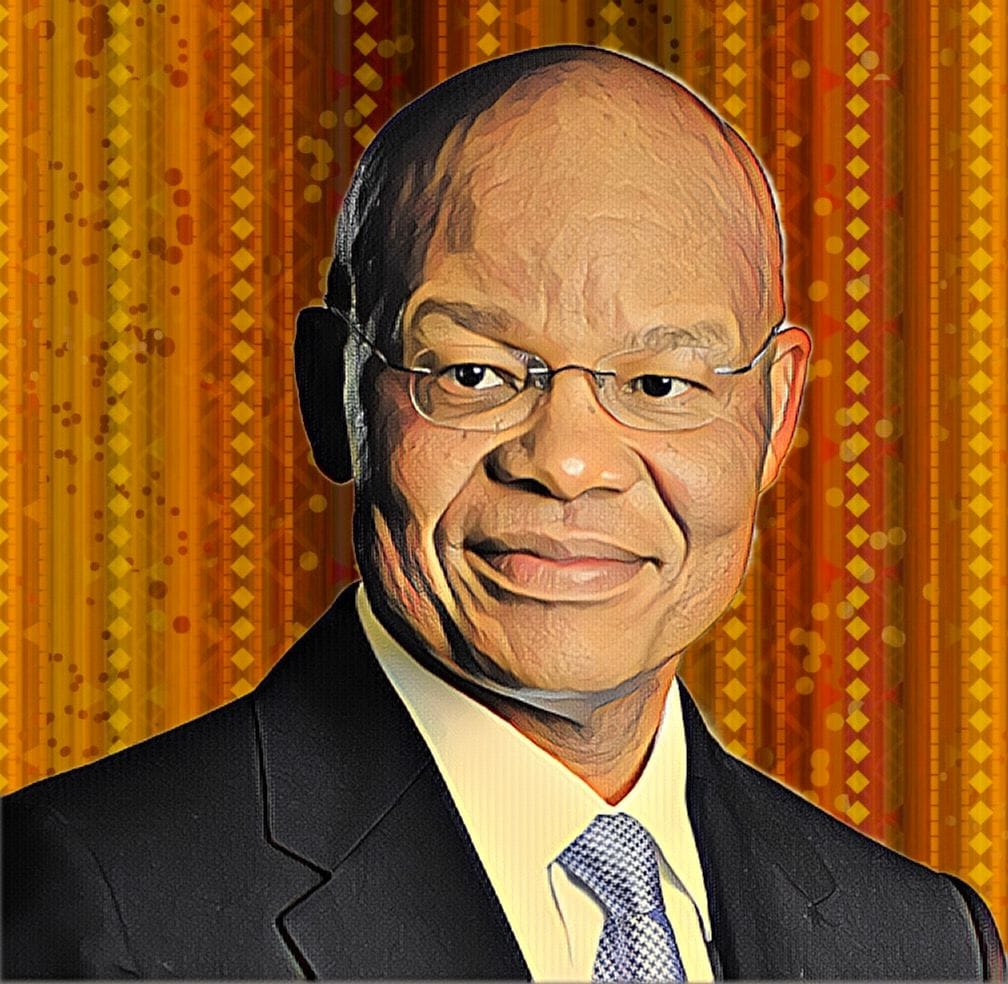

This IPO is the culmination of Pick 'n Pays two-part recapitalization plan to strengthen the companys financial health by reducing debt and channeling resources back into its core supermarket chain. Earlier this year, Pick 'n Pay raised R4 billion 2.2 million in a rights issue, and the additional funds from the Boxer IPO are expected to fully eliminate the groups debt, significantly lowering its interest expenses. The initial capital raised from the listing will mean Pick 'n Pay will be debt-free, with a strong balance sheet and a significantly reduced interest bill, noted Pick 'n Pay CEO Sean Summers.