- FCMB completed the first stage of its capitalization program, issuing 15.2 billion shares at N7.3 ($0.0044) each to strengthen its financial base and expand in Africa.

- Ladi Balogun highlighted the Central Bank of Nigeria and Nigerian Exchange Group's support in boosting investor confidence and ensuring the capital raise's success.

- FCMB Group plans to enhance services, community development, and shareholder value, while expanding its digital market access.

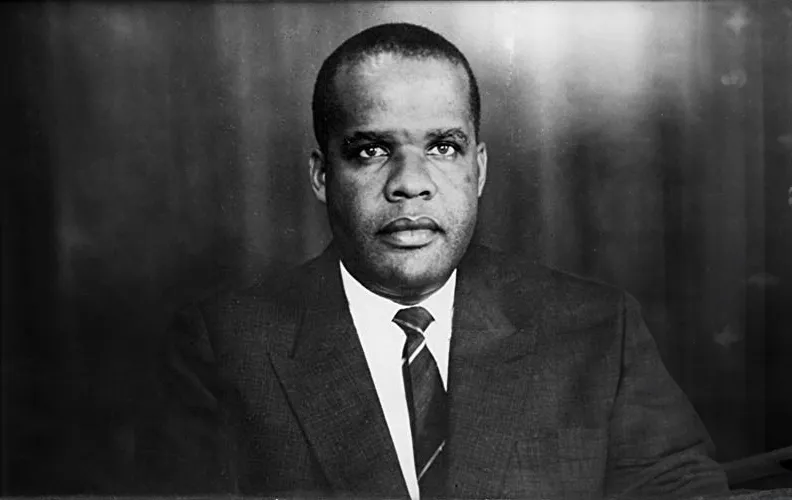

First City Monument Bank (FCMB), the flagship banking arm of FCMB Group, a Lagos-based financial services holding company led by Nigerian banking executive Ladi Balogun, has completed the initial stage of its capitalization program. This move is aimed at strengthening the bank's financial foundation and supporting its expansion within Africa's financial markets.

The capital raise involved the issuance of 15.2 billion ordinary shares priced at N7.3 ($0.0044) each. This crucial step is designed to fortify FCMB's balance sheet, improve service offerings, and contribute to community development while delivering substantial value to shareholders.

Strategic support and future plansLadi Balogun, Group Chief Executive of FCMB, emphasized the significant role of the Central Bank of Nigeria (CBN) and the Nigerian Exchange (NGX) in this process. Balogun credited their support for reinforcing investor confidence and ensuring the successful completion of the transaction.

This capital raise will not only enhance FCMBs balance sheet and customer services but also foster community development and shareholder value, Balogun said. He noted that the initiative is poised to drive economic transformation and bolster FCMBs position in Africas financial services industry.

Balogun also expressed optimism about FCMB Groups future, highlighting the capital raise as a critical step towards shared prosperity and long-term growth. He commended the NGX Invest platform, which allowed over 40,000 investors to participate digitally, marking a significant advancement in capital market access.