- Johan Burger's stake in FirstRand has dropped by R54.49 million 3.03 million after a 12.21 decline in share price over 70 days.

- FirstRands stock decline from R86.89 4.841 has reversed Burger's previous gains, dragging his stakebelow 24 million.

- Despite recent underperformance, FirstRand has delivered a modest 3.77 return for local investors and a 5.66 gain for foreign investors.

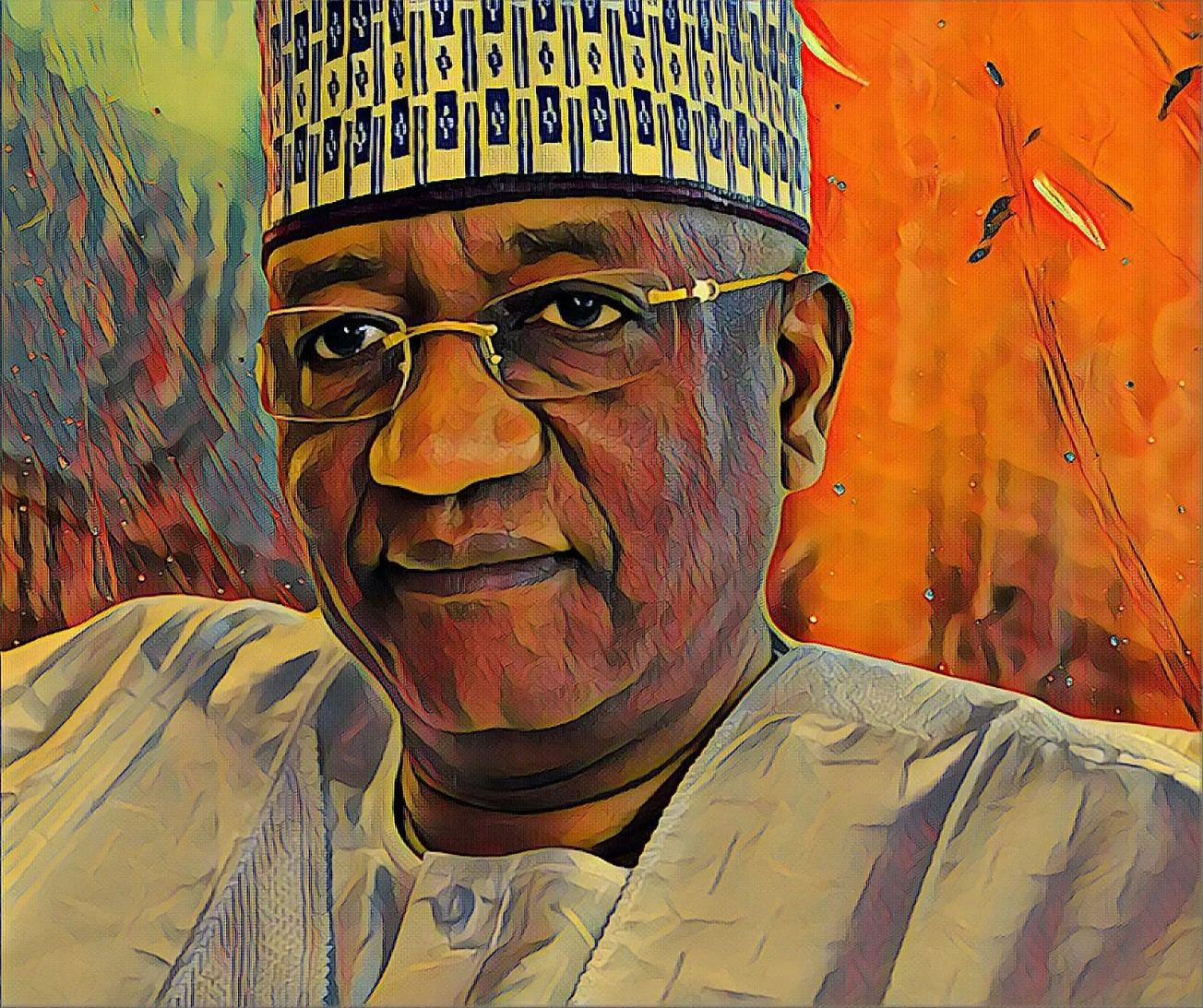

South African businessman Johan Burger, Chairman of FirstRand, has seen a significant decline in the market value of his stake in the leading lender, following a 12.21 percent drop in share price on the Johannesburg Stock Exchange JSE over the past 70 days.

Burger, who holds a 0.09-percent stake in FirstRandequivalent to 5,136,000 ordinary shareshas recorded a loss of R54.49 million 3.03 million over the past 70 days, dragging the market value of his stake in FirstRand below 24 million.

Stock decline weighs on Burgers holdingsFirstRand shares, which traded at R86.89 4.841 on Sept. 10, have fallen to R76.28 4.250, affecting the market capitalization of the Sandton-based lender, which now sits below 24 billion. The downturn in FirstRands share price has affected Burgers stake, which had previously risen in value.

Between June 6 and July 5, Burgers stake increased by 4.83 million , from 20.6 million to 25.43 million. However, the recent drop in share price has reversed those gains.

Impact on investorsDespite the losses, Burger remains a key figure in South Africa's financial sector. FirstRand , which operates through its major divisions, including FNB, RMB, WesBank, and Aldermore, continues to hold a dominant position in the African financial services market.